Anti-money Laundering Eu List Of High-risk Third Countries

A single EU rulebook to prevent money laundering and terrorist financing through a consistent EU -wide set of rules. The Anti-Money Laundering Directive was revised in order to provide a.

5amld 5th Anti Money Laundering Directive High Risk Third Countries

The aim is to protect the integrity of the EU financial system.

Anti-money laundering eu list of high-risk third countries. Money laundering high risk countries list. The sources of the money in actual are felony and the money is invested in a manner that makes it appear like. While the EU list of uncooperative tax jurisdictions is a Council-led.

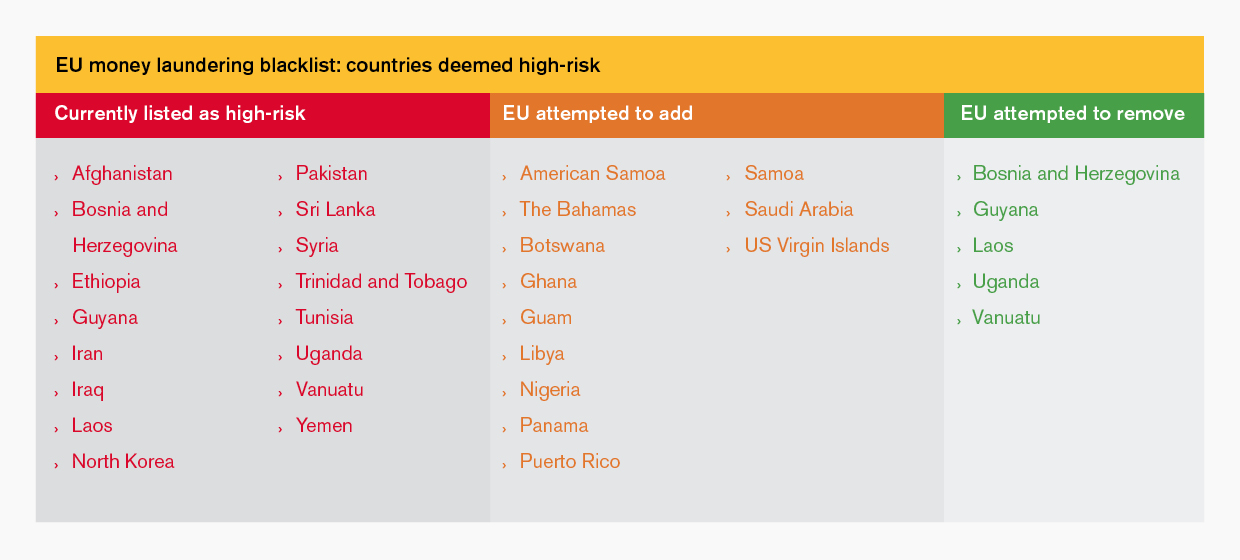

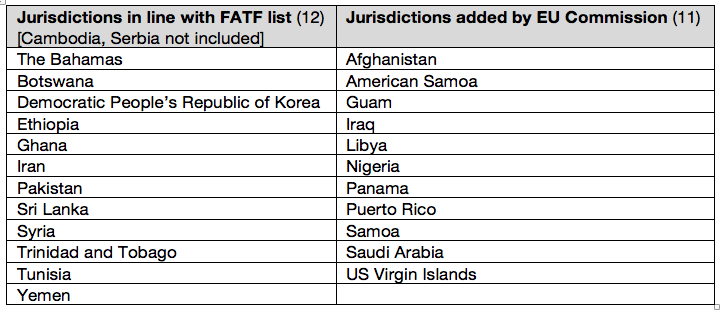

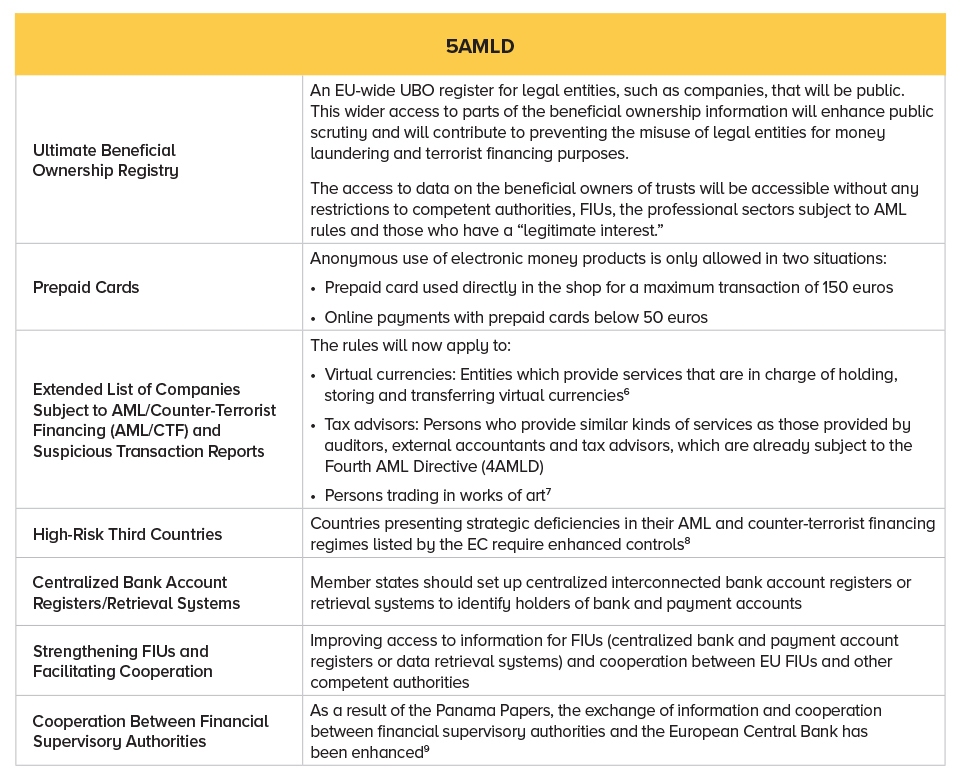

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. Which Countries Are High Risk For Money Laundering Edit. The Commission is required by Directive EU 2018843 5th Anti-Money Laundering Directive to identify high-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes.

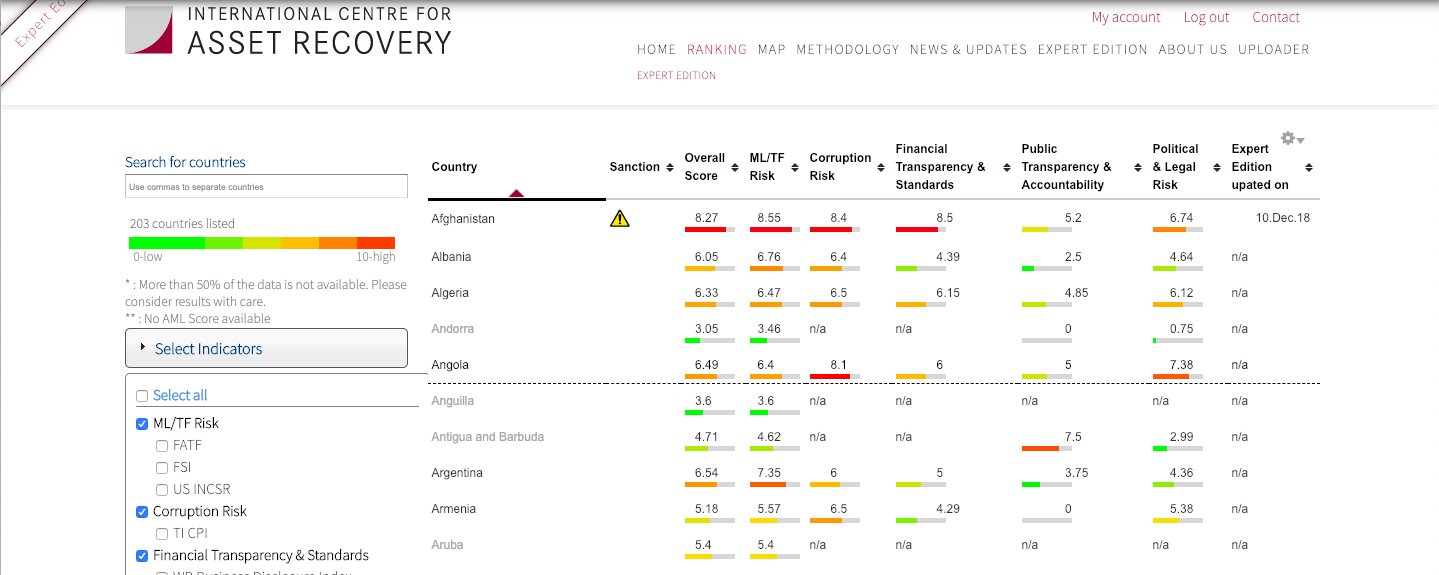

The European Commission has published its list of high-risk third countries dubbed the blacklist which it says have weak anti-money laundering and terrorist financing regimes. It says the list was established after an in-depth analysis and the that the method reflected the stricter criteria of the Fifth Anti-Money. The list has been established on the basis of an analysis of 54 priority jurisdictions which was prepared by the Commission in consultation with the Member States and made.

Money Laundering Risk By Country on August 10 2021. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. Updated list of high -risk third countries.

The aim of this list is to protect the EU financial system by better preventing money laundering and terrorist financing risks. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. The idea of cash laundering is very important to be understood for those working within the monetary sector.

The idea of cash laundering is very important to be understood for these working within the financial sector. It is a course of by which soiled cash is converted into clean money. The Commission is mandated to carry out an autonomous assessment and identify the high-risk third countries under the Fourth and Fifth Anti-Money Laundering Directives.

Commission Delegated Regulation EU 20161675 identified high-risk third countries with strategic deficiencies. Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism. EU list on high risk third countries.

One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism. The action plan consists of the following six broad areas of which at least the first three elements will probably be part of the AML package expected in 2021.

As a result of the listing banks and other entities covered by EU anti-money laundering rules will be required to apply increased checks due diligence on financial operations involving customers and financial institutions from these high-risk third countries to. Pursuant to Article 9 of Directive EU 2015849 the 4th Anti-Money Laundering Directive there is a legal requirement to identify third-country jurisdictions which have strategic deficiencies in their national AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. The sources of the cash in precise are prison and the cash is invested in a way that makes it appear to be clean cash and.

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. The FATF encourages all countries and jurisdictions to conduct improved due diligence on all listed countries as high-risk. Its a process by which soiled money is converted into clear cash.

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. The EU has amended its list of high-risk third countries as a step in its wider plan to overhaul its anti-money laundering and terrorist financing laws and. EU level supervision.

That Regulation should be reviewed at appropriate times in light of the progress made by those high-risk third countries in removing the strategic deficiencies in their regime on anti-money laundering and countering terrorist financing AMLCFT. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. Money Laundering High Risk Jurisdictions Edit.

Eu Commission High Risk Third Countries Must Do Better Financial Crime News

High Risk Third Countries An Aml Challenge For The Eu Arachnys

Eu Policy On High Risk Third Countries European Commission

Basel Aml Index Expert Edition Adds Eu List Of High Risk Third Countries Basel Institute On Governance

Eu Policy On High Risk Third Countries European Commission

What Does Europe S Anti Money Laundering Overhaul Mean For Trade Finance Global Trade Review Gtr

Keeping Up With Money Laundering Risks Updates To This Year S Basel Aml Index Methodology Basel Institute On Governance

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium

Eu Commission High Risk Third Countries Must Do Better Financial Crime News

The Controversial Eu List Of High Risk Third Countries Global Risk Affairs

The Eu S Amended List Of High Risk Third Countries Comes Into Force

12 Europeanframework Table2 Acams Today

Eu Amends Aml List Of High Risk Countries Financial Institutions Hub

Tools To Support Enhanced Due Diligence In Response To New Eu List Of High Risk Third Countries Basel Institute On Governance

Eu Policy On High Risk Third Countries European Commission

Anti Money Laundering Compliance For Crypto Exchanges 2021 Update

The Eu 5 Th Anti Money Laundering Directives Download Scientific Diagram

Eu Commission High Risk Third Countries Must Do Better Financial Crime News

The Controversial Eu List Of High Risk Third Countries Global Risk Affairs

Post a Comment for "Anti-money Laundering Eu List Of High-risk Third Countries"