Anti Money Laundering Guidelines Help In

Who needs to register for money laundering supervision. Banks and other financial institutions are legally obligated to follow AML regulations to ensure that they do not.

Anti Money Laundering Overview Process And History

Guidelines on Anti-Money Laundering AML Standards and Combating the Financing of Terrorism CFT Obligations of Securities Market Intermediaries under the Prevention of Money Laundering Act 2002 and Rules framed there under.

Anti money laundering guidelines help in. As such they have a significant role to play in ensuring their services are not used to further a criminal purpose. This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. Apply for the fit and proper test and HMRC approval.

CCAB guidance Welcome to the Anti-Money Laundering Guide previously named Money Laundering Handbook. This section outlines the anti-money laundering AML roles responsibilities and appointment of senior individuals in a practice including the money laundering reporting officer MLRO money laundering compliance officer MLCO and beneficial owners officers and managers BOOMs as well as some of the structures that practices must or should put in place eg. Financial Intelligence Units FIU 8.

De Nederlandsche Bank DNB conducts integrity supervision of a wide range of financial and other institutions. These guidelines provide guidance to capital markets intermediaries on the requirements in Notice SFA 04-N02 to Capital Markets Intermediaries on Prevention of Money Laundering and Countering the Financing of Terrorism. This guide is important because it will help you comply with the law.

It provides that obliged entities shall apply customer due diligence requirements when entering into a business relationship ie. ANTI-MONEY LAUNDERING GUIDANCE FOR THE ACCOUNTANCY SECTOR ICAEW ICAE W. This legislation has been constantly revised in order to mitigate risks relating to money.

Money laundering schemes are used to conceal the source and possession of money obtained through illegal activities such as drug trafficking and terrorism. It is intended to be read by any member who. With compliance penalties including fines and prison terms life insurance firms should ensure they understand their obligations and how to implement them as part of their AML policy.

A Bankers Guide to Avoiding Problems second edition June 1993. Give overall responsibility for anti money-laundering systems and controls to a director or senior manager. This booklet presents basic.

Effect of non-compliance 7. This document is a general guide defining Anti-Money Laundering AML Counter Terrorist Finance CTF Counter Fraud Procedures regulations the Risk- Based approach and gives some examples of what can be deemed to be money laundering. Why is this guide important.

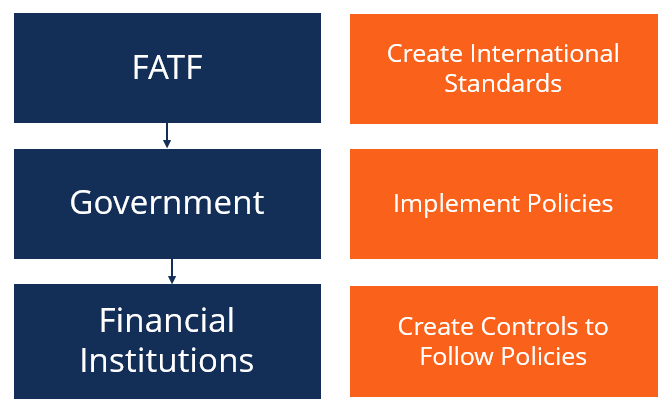

Comptroller of the Currencys OCCs prior publication Money Laundering. Where applicable interpretation of other. Anti Money Laundering guidelines represent the rules regulations and AML obligations set to detect and prevent money laundering and other financial crimes.

Accordingly governments and international authorities implement a range of anti-money laundering life insurance regulations and issue life insurance sanctions lists. This revision was prompted by the growing sophistication of money launderers a growing international response to money laundering changes to anti-money laundering laws and recent anti-terrorist nancing legislation. They should be read in conjunction with the notice.

The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. 11 This Guideline is published under section 7 of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance AMLO and section 73 of the Banking Ordinance BO. Identify and verify the identity of clients monitor transactions and report suspicious transactions.

Any financial crime that cannot be detected and prevented causes crime organizations to increase their criminal activities. The Money Laundering Regulations in the United. It covers the prevention of money laundering and the countering of terrorist financing.

Accountancy sector guidance for money laundering supervision. Other authorities ensuring implementation of anti-money laundering measures. Guideline on the Anti-Money Laundering and Anti-Terrorist Financing Act and the Sanctions Act 5 1 Introduction In addition to solidity integrity is a prerequisite for a sound financial system.

This guidance is based on the law as of November 2018. As professionals accountants must act with integrity and uphold. KYC and Anti Money LaunderingCounter-Financing of Terrorism AMLCFT Guidelines for Insurers 510.

They should know about the money-laundering risks to your firm and make sure steps are taken to mitigate those risks effectively appoint a Money Laundering Reporting Officer MLRO who is a focus for the firms AML activity. It is impossible to determine the exact amount but billions of dollars of financial crimes are committed each year. Anti-money laundering AML policies are put in place to deter criminals from integrating illicit funds into the financial system.

12 Terms and abbreviations used in this Guideline should be interpreted by reference to the definitions set out in the Glossary part of this Guideline. Anti Money LaunderingCounter-Financing of Terrorism AMLCFT Guidelines for Postal schemes 511. This Anti-Money Laundering Guidance has been developed by a CCAB-I working party comprising staff and volunteer practitioners and has been approved for issue by bodies affiliated to the CCAB-I.

2 Introduction Accountants are key gatekeepers for the financial system facilitating vital transactions that underpin the UK economy.

Explore Our Sample Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

What Is Anti Money Laundering Aml Money Laundering Financial Literacy Money

Discover 7 Top Anti Money Laundering Aml Solutions

Anti Money Laundering What It Is And Why It Matters Sas

Aml Compliance Checklist Best Practices For Anti Money Laundering

Pin On Law Books And Study Aids For Law Studends Lawyers Jurists Or Judges

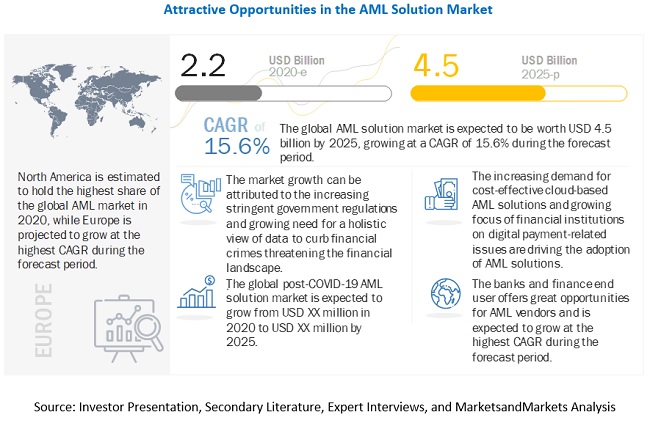

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Anti Money Laundering In A Nutshell Awareness And Compliance For Financial Personnel And Business Managers By Kevin Sullivan Apress Money Laundering Anti Money Laundering Law Bank Secrecy Act

4 Ways Regtech Will Revolutionise Aml Compliance Disruptive Technology Onboarding Process Anti Money Laundering Law

Anti Money Laundering Overview Process And History

Pin On Compliance Regulations Kyc Kyb Aml Ftc

Get Our Image Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

Anti Money Laundering Overview Process And History

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Service Blueprint Anti Money Laundering Law Money Laundering

Pin On Compliance Regulations Kyc Kyb Aml Ftc

Anti Money Laundering Compliance Program Steps To Mitigate Risks

Post a Comment for "Anti Money Laundering Guidelines Help In"