Types Of Risk Associated With Money Laundering

We found that some we visited needed to be more aware of the money-laundering risks in the capital markets and many were in the early stages of their thinking in relation to these risks and needed to do more to fully. A banks risk assessment mechanism should be commensurate with its business nature and scale.

Financial Crimes Osint Tools Banking Osint Tools Banking Computer Knowledge

To understand these risks lets take a look at the third-party payment flow and bring out the iterated anti-money laundering AML measures as well as the major difficulties to implement them.

Types of risk associated with money laundering. THE RISK FACTORS GUIDELINES. Instead of creating a shell company an alternative for money laundering may be to invest in a legitimate business such as a casino or bar. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing.

The launderer can combine his illicit funds with the real income of the business or use the companys bank. Financial institutionsbanks credit card companies investment brokers etcare under scrutiny to comply with AML requirements as are casinos and dealers in hard goods such as automobile boat and airplane dealers and jewelers. 2 Compliance and reporting obligations Status of these joint guidelines This document contains joint guidelines issued pursuant to Articles 16 and 561 of Regulation EU No 10932010 of.

Risks associated with each business are different. Theoretically someone could purchase a piece of real estate property with cash and quickly sell it. The Opinion has been issued in accordance with Article 65 of EU 2015849 The Fourth EU Anti-Money Laundering Directive which requires the EBA to issue an Opinion on the risks of ML and TF affecting the EUs financial sector every two years.

When assessing the money laundering and terrorist financing risk associated with individual business relationships and occasional transactions The Risk Factors Guidelines. Looking for a specific entry in a spreadsheet or a single e-mail can be daunting but. The associated money laundering risks should not be overlooked.

Limited number of predicate crimes for money laundering. Certain industries such as insurance and real estate are also being scrutinized for potential money laundering. A bank should take such business diversity into account when assessing and mitigating MLTF risks.

Any profits made would be associated with the sale and are completely legal. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. Many kinds of businesses are at risk for money laundering and for penalties if AML programs do not meet regulatory standards.

While most Cash Intensive Businesses CIBs are conducting legitimate business some aspects of these businesses may be susceptible to money laundering or terrorist financing. To build a robust case and to comply with statutory rules investigators must understand the various ways information can be stored and retrieved. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg.

When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular. Cash Intensive Businesses Managing Their Money Laundering Risks. Payment processes usually involve five functions.

Money laundering is a means of storing or transporting money while obscuring its true origin. You can decide which areas of. Limited types of institutions and persons covered by money laundering laws and regulations.

According to the Report from the Commission to the European Parliament and to the Council on the assessment. The highly lucrative gold market also presents proceed-generating opportunities. Risks you cant ignore 3 Gathering securing and preserving evidence Technology is an essential component of almost every investigation.

The examples provided in the Guidelines are not mandatory requirements. For a bank that is relatively small or has relatively simple businesses a. The money-laundering risks we identified are mitigated to an extent by the nature of the firms in the market however there remain some risks particular to the capital markets.

The Opinion and its associated report will inform the European Commissions Supranational Risk Assessment SNRA and risk assessments. It has a stable value it is anonymous and easily transformable and interchangeable. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering.

The joint FATF-AsiaPacific Group on Money Laundering report money laundering terrorist financing vulnerabilities associated with gold identifies the many features that make gold attractive to criminals to use as a vehicle for money laundering. There are circumstances where the risk of money laundering or terrorist financing is higher and enhanced CDD measures have to be taken. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with.

11 Undermining the Legitimate Private Sector One of the most serious microeconomic effects of. Although a legitimate business tactic the increased use of property flipping for money-laundering purposes can make the tactic seem suspicious. Little to no enforcement of the laws weak penalties or provisions that make it difficult to confiscate or freeze assets related to money laundering.

Eu Policy On High Risk Third Countries European Commission

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form

Infographic Money Laundering Is The Process By Which Criminals Conceal The Original Source Of Money To Make It Appear As It S Been Earned Via A Legitimate

Combatting Money Laundering And Terrorist Financing Government Se

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Computer Basics

The History Of Financial Crime Exploring Examples Of Modern Money Crimes Enterprise Risk Management Software Businessforensics

Money Laundering And Financial Risk Management In Latin America With Special Reference To Mexico

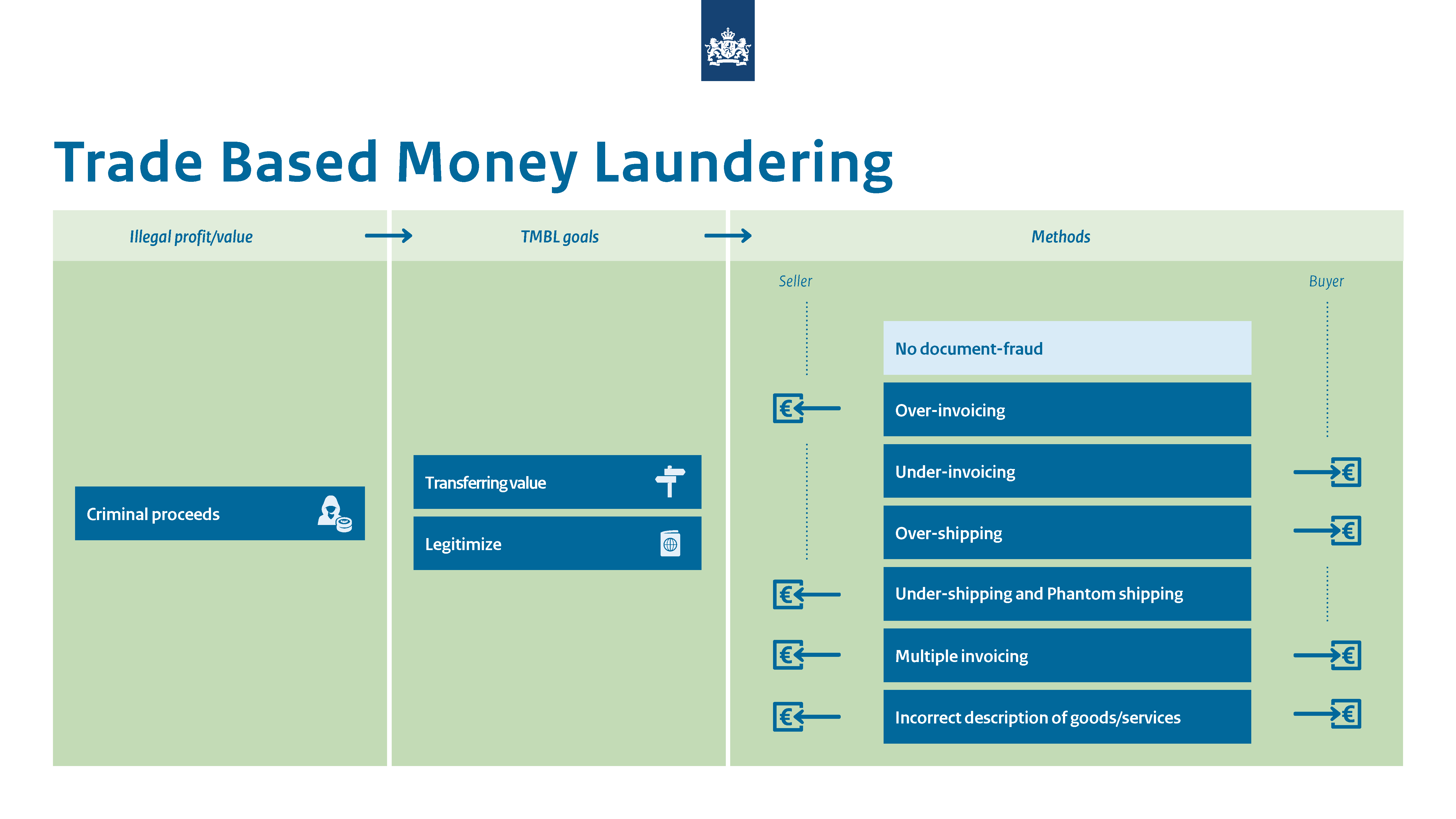

Anti Money Laundering 2021 Netherlands Iclg

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Your Amlrx For Covid 19 Part One Acams Today

Become A Certified Anti Money Laundering Specialist Today Risk Management Risk Advisory University Of Ghana

What Is The Real Money Laundering Risk In Life Insurance High Risk Low Risk Or No Risk That Is The Question Acams Today

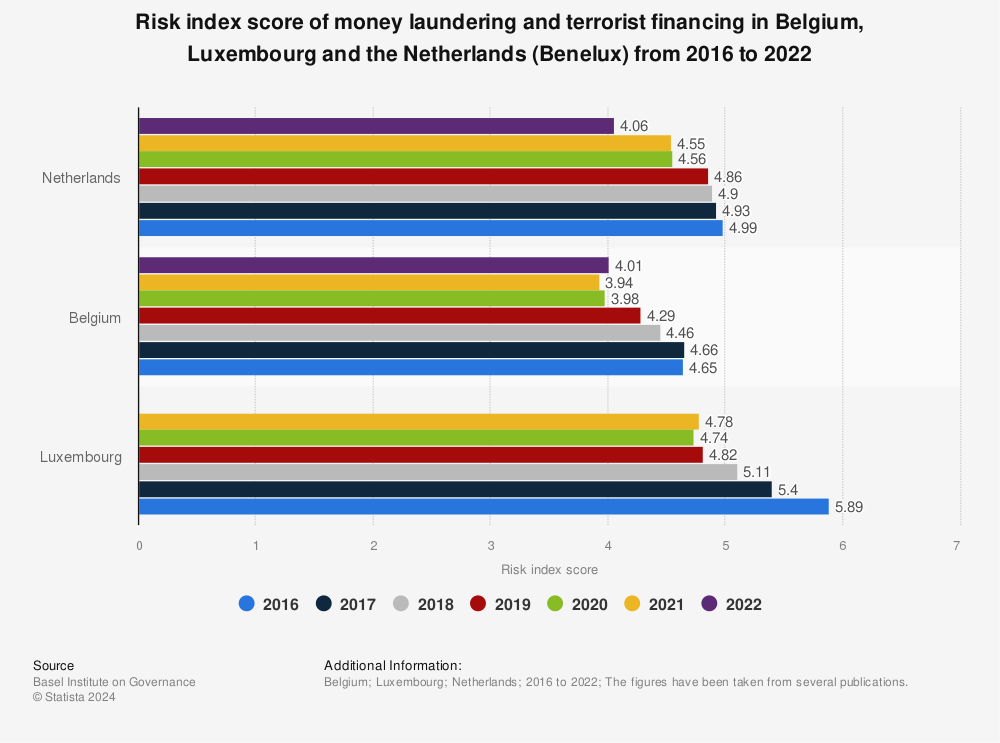

Belgium Luxembourg Netherlands Risk Index Of Money Laundering And Terrorist Financing 2016 2020 Statista

Know Your Customer And Anti Money Laundering Measures Ing

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

Anti Money Laundering Programmes Systems Financetrainingcourse Com

Post a Comment for "Types Of Risk Associated With Money Laundering"