What Are The Main Types Of Sanctions In Money Laundering Canada

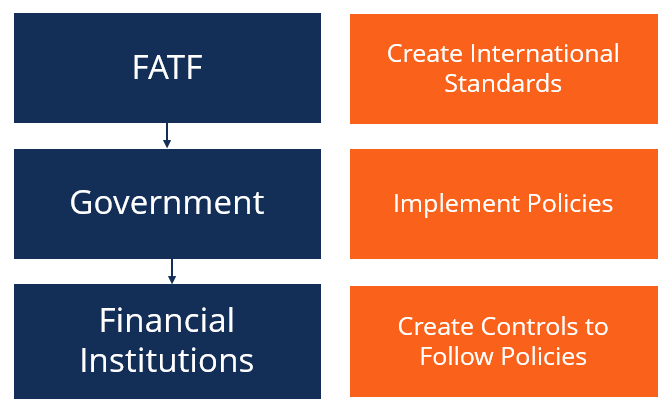

In 2015 Canada underwent the FATF peer review process and the final report was published in September 2016. The strictest sanctions enforcers require little in the way of proof and can issue substantial penalties based merely on apparent sanctions violations including suspected money laundering and terrorist financing.

Aml Screening How It Might Infiltrate Your Business

Jun 4 2019 4 min read Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF.

What are the main types of sanctions in money laundering canada. The Criminal Codes obligations cover all individuals and businesses. Anti-Money Laundering Laws and Regulations in Canada Canada has two main laws for preventing money laundering and terrorist financing. Examples of sanctions lists include the United States Specially Designated Nationals and Blocked Persons SDN List and the consolidated lists used by the United Kingdom the European Union and the United NationsSanctions lists are generally made available online so that businesses are.

CIBC is committed to protect the safety soundness and reputation of CIBC by reducing the likelihood that CIBC will be used as a vehicle for or become a victim of Money Laundering or Terrorist Financing MLTF activities. Anti-money Laundering Anti-terrorist Financing and Sanctions. Governments and financial authorities around the world maintain a variety of targeted sanctions lists.

The Financial Transactions and Reports Analysis Centre of Canada FINTRAC recently released the final version of the regulations amending the Regulations to the Proceeds of Crime Money Laundering and Terrorist Financing Act as amended the RegulationsThe Regulations govern anti-money laundering AML rules in Canada. Howe Institute report titled Why We Fail to Catch Money Launderers 999 of the Time I estimate money laundering in Canada at. On May 9 an expert panel on money laundering issued its report Combatting Money Laundering in BC Real Estate in which it estimated 2018 money laundering in Canada at 467 billion.

The Office of the Superintendent of Financial Institutions OSFI began publishing lists of names on its website in 2003 to assist federally regulated financial institutions FRFIs in meeting their obligations to conduct monthly reporting in relation to new legislation. - The BSA requires financial institutions to have an anti -money laundering compliance program and comply with a number of reporting and recordkeeping requirements. A proactive pre-emptive pragmatic and results-oriented approach to sanctions.

Types of sanctions. On 23 May 2018 the Sanctions and Anti-Money Laundering Act became law in the United Kingdom. The Criminal Code and the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA play an active role in Canadas AML regime.

Its aim is to provide a legal framework to allow the UK to impose sanctions and implement its own sanctions regime once the UK leaves the EU on 29 March 2019. The report found that Canada has a good understanding of its money laundering and terrorist financing risks and that AMLATF cooperation and coordination are generally good at the policy and operational levels. In a recent CD.

The ML threat was rated very high for corruption and bribery counterfeiting and piracy certain types of fraud illicit drug trafficking illicit tobacco smuggling and trafficking and third-party money laundering. Profit-motivated crimes span a variety of illegal activities from drug trafficking and smuggling to fraud extortion and corruption. Or the seizure or freezing of property situated in Canada.

The changes in the Regulations are quite substantial and. The main source for AML reporting recordkeeping and compliance program requirements for financial institutions is the Bank Secrecy Act BSA. Transnational organized crime groups OCGs and professional money launderers are the key ML threat actors in the Canadian context.

The Sanctions and Anti-Money Laundering Act 2018 is the means by which the UK government will be able post-Brexit to both lift sanctions that should not be. An Iranian-Canadian man has been accused of bank fraud in an alleged money laundering and sanctions evasion scheme involving Irans government a state-owned oil company in Venezuela and a. New UK sanctions regimes came fully into force under the Sanctions and Anti-Money Laundering Act 2018 the Sanctions Act at 11pm on 31 December 2020.

Sanctions imposed by Canada on specific countries organizations or individuals vary and can encompass a variety of measures including restricting or prohibiting trade financial transactions or other economic activity between Canada and the target state. The UKs Sanctions and Anti-Money Laundering Act Enters into Law. Furthermore CIBC is also committed to comply with applicable Economic Sanctions laws and prevent activities involving sanctions targets.

The scope of criminal proceeds is significant - estimated at some 590 billion to 15 trillion US. Money laundering is the process used to disguise the source of money or assets derived from criminal activity.

Chapter Two Civil Law Vs Criminal Law Cases Criminal Law Attorney Studying Law Criminal Law

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Vancouver Money Laundering Model Complyadvantage

Anti Money Laundering Overview Process And History

Canada Anti Money Laundering And Anti Terrorist Financing Complyadvantage

Anti Money Laundering 2021 Mexico Iclg

As The U S China Tech War Rages On The Electronics Industry Braces For Impact Emerging Technology Semiconductor Innovation Technology

5 Basic Money Laundering Offences Deltanet

The Etias Of Europe Is A New Travel Authorization System Which Will Replace The Visa Free Facility Available To 61 Countries New Travel European Travel Europe

What Is Anti Money Laundering Sanction Scanner

Anti Money Laundering Overview Process And History

5 Methods That Modern Money Launderers Use To Beat Detection Tookitaki Tookitaki

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Pin By Larry Saldanha On Canada World Video On Demand Movies Mercy

Aml Compliance Checklist Best Practices For Anti Money Laundering

Ofac Sanctions What Is It And Who Is It For Complyadvantage

Will India Ban Crypto 5 Exchange Executives Shed Light On The Truth Developed Economy How To Get Money Smart Money

Anti Money Laundering How To Protect Your Small Business Veem

Post a Comment for "What Are The Main Types Of Sanctions In Money Laundering Canada"