What Are The Source Of Funds For A Sole Proprietorship

You dont want to go overboard and give out a majority stake of your company. More so that proprietor provides the initiative controls the business and retains all the profit arising from the business.

Benefits And Drawbacks Of Sole Proprietorship Course Hero

Here are sources of capital for a sole proprietorship business.

What are the source of funds for a sole proprietorship. The sole trader can approach a bank or a financial institution to apply for a loan. It is up for the individual to decide whether he wants to keep his savings or use them to buy equipment vehicles tools or other things his businesss needs. They have no value beyond yourself.

You will probably find it easier and faster to apply for funding from alternative sources. The person who owns and runs this type of business sole proprietorship business is called a sole proprietor. Answered Dec 24 2020 by nkivory2.

Answered Dec 24 2020 by. Not just sole traders every type of business will definitely look into personal savings to start a business. Hence a business establishment in which a single person owns controls and manages all the business activities is a sole proprietorship form of business ownership.

Small Business Administration The few sources of money available to the sole proprietorship are banks family friends the Small Business Administration andor his or her personal funds selling stock or issuing bonds is. Trade credit and credit cards are preferred by sole traders as these will usually not require a mortgage of the business assets. All of the following represent a source of funds for a sole proprietorship except.

They are one of the best sources of finance for a sole. Retained profits are the profits made in previous years of trading over and above what you need to finance your day-to-day expenses. This is usually the first place to look.

Characteristics of sole proprietorship are that the owners are inseparable from the business. In a sole proprietorship you own 100 of the business. Personal funds DSelling stock or issuing bonds E.

Your ability to get approved will depend on your credit history business profitability and ability to come up with collateral. A bank loan is another source of funds for sole proprietors but it is a very difficult task. Search and apply for business grants.

This could include a business loan a credit line credit cards trade credit and a mortgage. Crowdfunding is rapidly becoming a common practice these days which is the reason why it is considered one of the best sources of capital to start your business. In the case of a sole proprietor the only source of funds in most of the cases is the personal savings of the owner.

Crowdfunding is typically done via the internet. These are primarily concerned with your current business revenues and are far. Obviously to start a business you need capital isnt it.

Sole Proprietorship Whats the Advantage If playback doesnt begin shortly try restarting your device. Which of the following is not a source of fund for sole-proprietorship. Put simply personal savings is the the amount of money a person has at his disposal.

Banks tend to want to loan money to big businesses. A sole proprietor is self-employed carries out the day-to-day responsibility of running the business. For example you might draw money from your personal savings account CDs you own or a self-employed retirement plan.

Sole proprietorships have nothing that you can give out. See below for the correct answer. While you do the planning alone design the marketing strategies you will also bear the full financial responsibility here are the five sources of capital for a sole proprietorship.

Trade credit is mostly secured against the accounts receivable and the work in progress of the sole. How To Raise Fund As a One-Man Business. Accessing funding isnt easy for most sole proprietors.

It becomes a source of finance when the sole trader or a partnership member is willing to invest it in his business. However we should remember that those who lend money and extend credit to the sole proprietorship also. Over the years numerous businesses and projects have been able to see the light of the day thanks to crowdfunding.

The LLC structure allows you to put a valuation on the worth of your business and trade small percentages of ownership for real dollars. Friends and relatives are common sources of investment for sole proprietorship businesses. Videos you watch may be added to.

That means that your borrowing options would be limited to using your own assets. 100 correct and accurate. Sole Proprietor 0 votes.

Because sole proprietorships are so closely owned and managed individuals who know the owner well and. Banks may not issue funds without some collateral which can be a challenge for many individuals. What are the Sources of Capital For A Sole Proprietor.

He organizes the resources and controls the activities with the sole. What will be an ideal response. What is the source of start-up for a sole proprietorship.

Sole Proprietorship Whats the Advantage - YouTube. Asked Dec 24 2020 in Business by osobear13. The owner takes all the risks and bears all the losses sustained in any bad year.

How To Convert Sole Proprietorship To A Private Limited Company Rikvin

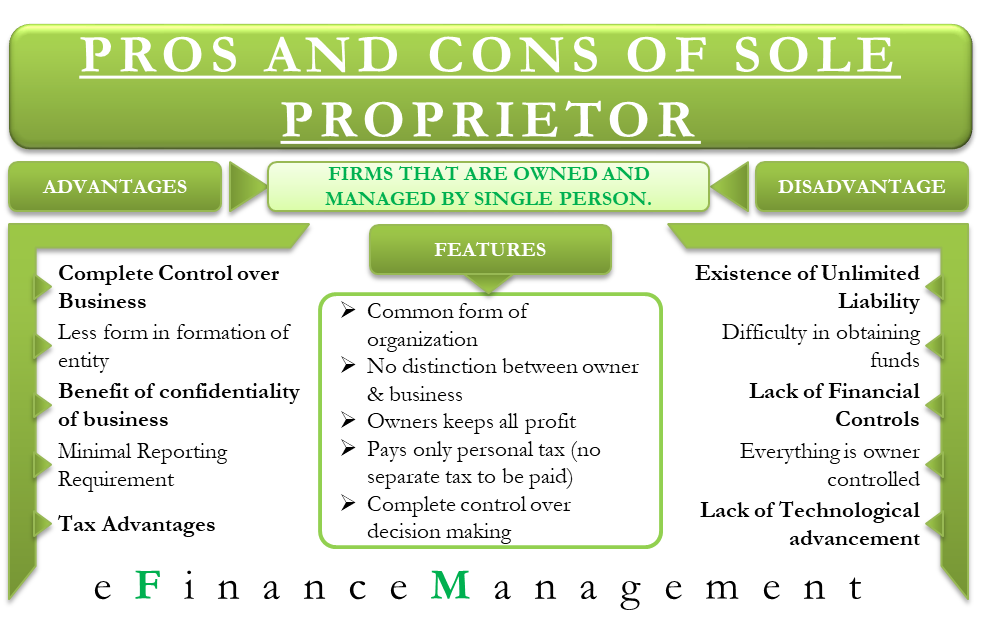

Advantages And Disadvantages Of Sole Proprietorship Efm

41 Comparing Corporations To Sole Proprietorships In Speech Therapy Private Practice Privateslp

Sole Proprietorship Get A Complete Idea About It Office Captain

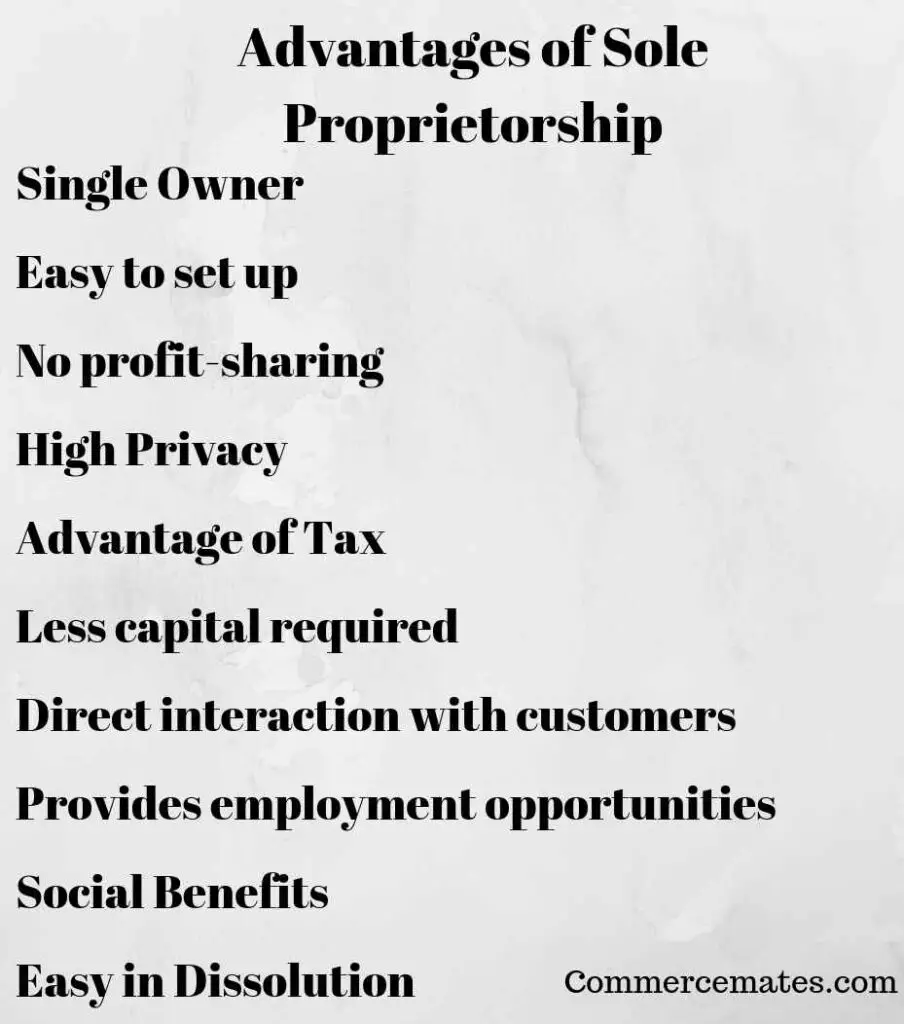

10 Advantages Of Sole Proprietorship

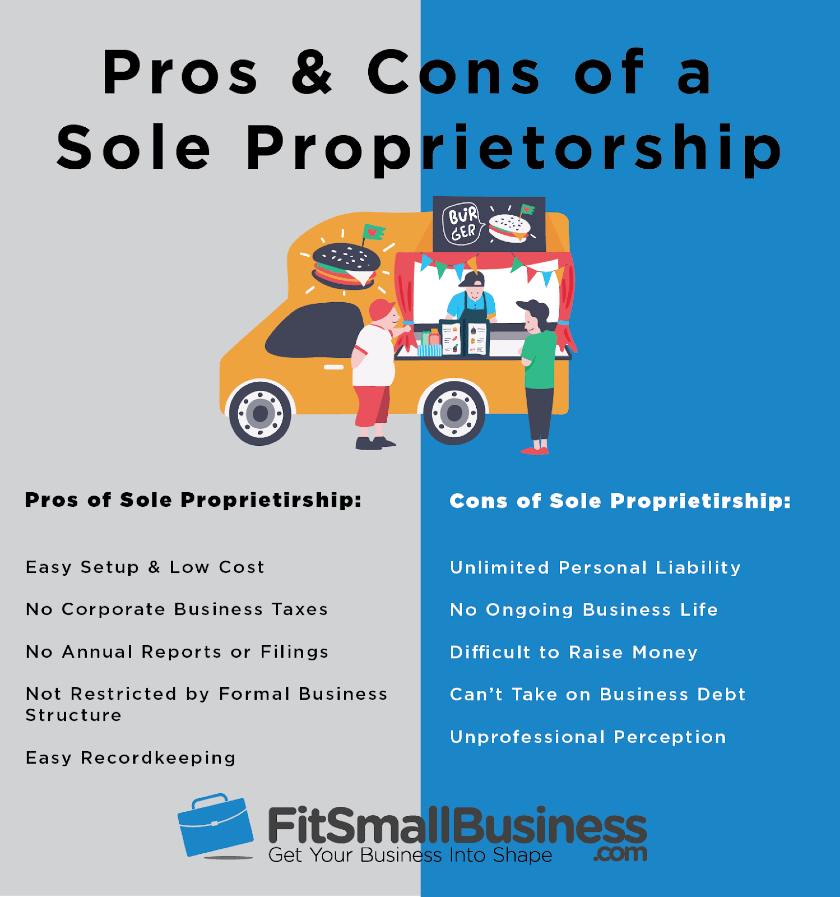

5 Sole Proprietorship Pros And Cons

Taxday Sole Proprietorship Conversation Tax Day

What Are The Advantages And Disadvantages Of Sole Proprietorship Posts By Filing Bazaar Bloglovin

8 Limitations Of Sole Proprietorship

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Sole Proprietorship Business Basics

Reading Sole Proprietorship And Partnerships Introduction To Business

Sole Proprietorship One Man Control Is The Best In The World If That One Man Is Big Enough To Manage Everything By Shadhin Kangal Medium

Choosing Financial Structure For Your Startup Visual Ly Sole Proprietorship Business Structure Business Law

Sole Proprietorship Definition Features Characteristics Advantage Disadvantages

Sole Proprietorship Meaning Features Needs Advantages Disadvantages

A Guide To Business Loans For Sole Proprietors Funding Circle

Sole Proprietorship Definition Features Characteristics Advantage Disadvantages

Sole Proprietorship Features Advantages Disadvantages With Examples

Post a Comment for "What Are The Source Of Funds For A Sole Proprietorship"